Reservoirs containing petroleum in trapping circumstances are routinely subject to change by a variety of processes.

Any petroleum-bearing trap is eventually subject to erosion and dissipation of the hydrocarbons.

Folding, faulting, fracturing and intense manifestations of all these can destroy any trap in a position to be affected by them. Extreme deformation accompanied by erosion can easily eliminate petroleum traps.

Exposure of hydrocarbons to weathering effectively eliminates them. Any time that deformation and erosion damage or eliminate a trap, weathering and oxidation complete the degradation of the petroleum.

Deep burial of a reservoir can eliminate the contained petroleum by increasing the temperatures beyond the normal tolerance levels. Oil in particular can be altered to gas by high temperatures increasing with depth. Origin, migration and accumulation of petroleum obviously involve numerous factors that are the primary considerations in the establishment of petroleum – related parameters. Hydrocarbons form from organic materials in complex ways that are not completely understood. They migrate in ways that are subject to debate. They accumulate under conditions that allow for reduced recoveries under some circumstances and greater recoveries under others.

Factors that affect reservoirs affect the fluids they contain and therefore the methods required for production.

Applications (Some Facts)

Applications (Some Facts)

|

* the final total product of a refined barrel of crude oil may exceed 1 barrel, since some of the lighter liquids are in a near gaseous state and accordingly, take up more volume.

| Final Products Made from Crude Oil | |||

| This list is only a sampling of the products made from crude oil. It is not intended to be all-inclusive. Rather it is meant to show in just how many areas products made from crude oil are found and used. | |||

| Ink | Cosmetics | Sneakers | Crayons |

| Heart valves | Bubble gum | Parachutes | Car bodies |

| Telephones | Tires | Basketballs | House paint |

| Tape | Ammonia | Antiseptics | Eyeglasses |

| Purses | Life jackets | Deodorant | Fertilizers |

| Movie film | Shoes | Loudspeakers | Volleyballs |

| Combs | Floor-wax | Gasoline | |

Certain types of resultant hydrocarbons may be mixed with other non-hydrocarbons, to create other end products:

|

|

|

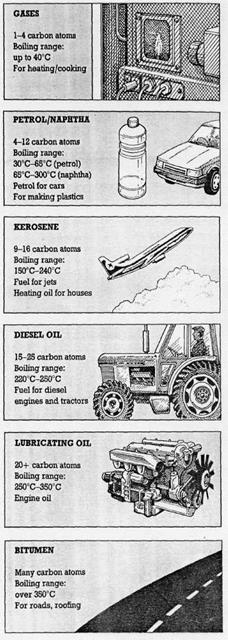

- Alkenes (olefins) which can be manufactured into plastics or other compounds

- Lubricants (produces light machine oils, motor oils, and greases, adding viscosity stabilizers as required).

- Wax, used in the packaging of frozen foods, among others.

- Sulfur or Sulfuric acid. These are useful industrial materials. Sulfuric acid is usually prepared as the acid precursor oleum, a byproduct of sulfur removal from fuels.

- Bulk tar.

- Asphalt

- Petroleum coke, used in specialty carbon products or as solid fuel.

- Paraffin wax

- Aromatic petrochemicals to be used as precursors in other chemical production.

Oil Reserves

Estimating reserves

After the discovery of a reservoir, a programme of appraisal will seek to build a better picture of the accumulation. In the simple text book example of a uniform reservoir, the first stage is to use seismic to determine the possible scope of the trap. Appraisal wells can be used to determine the location of oil-water contact and with it, the height of the oil bearing sands. Coupled with the seismic data, it is possible to estimate the volume of oil bearing reservoir.

The next step is to use information from appraisal wells to estimate the porosity of the rock. This is usually between 20-35%, meaning that 20-35% of the volume contains fluids rather than solid rock. This can give a picture of the actual capacity. Through core samples, the characteristics of the reservoir fluids can be determined, particularly the shrinkage factor of the oil (how much the oil will shrink as a result of being brought from the high pressure, high temperature environment of the reservoir to stock tank conditions at the surface.

With this knowledge, it is then possible to estimate how many stock tank barrels of oil are located in the reservoir. This is called the Stock Tank Oil Initially In Place (STOIIP). As a result of studying things such as the permeability of the rock (how easily fluids can flow through the rock) and possible drive mechanisms, it is possible to then estimate the recovery factor (what proportion of the oil in place can be reasonably be expected to be produced). This is normally between 40-50%. This finally gives a value for the recoverable reserves.

|

|

|

The difficulty in practice is that reservoirs are not uniform masses. They will have a variable porosities and permeabilities throughout and may be compartmentalised, with fractures and faults breaking it up and complicating fluid flow. As such require a lot of effort and instinct to produce even an approximate picture of the reservoir properties for estimating reserves.

Oil reserves refer to portions of oil in place (STOOIP) that are recoverable under economic constraints. Oil in the ground is not a "reserve" unless it is economically recoverable, since as the oil is extracted, the cost of recovery increases incrementally. The recovery factor (RF) is the percentage of STOOIP which is economically recoverable under a given set of conditions.

Categories of oil reserves

Proven, probable and possible reserves are the three most common categories of reserves. They represent the certainty that a reserve exists based on the geologic and engineering data and interpretation for a given location. The international authority for reserves definitions is generally the Society of Petroleum Engineers. The U.S. Securities and Exchange Commission has, in recent years, demanded that oil companies with exchange listed stock adopt reserves accounting standards that are consistent with common industry practice.

Definition of oil reserves

Countries with largest oil reserves

Oil reserves are primarily a measure of geological and economic risk — of the probability of oil existing and being producible under current economic conditions using current technology. The three categories of reserves generally used are proven, probable, and possible reserves.

- Proven Reserves - defined as oil and gas "Reasonably Certain" to be producible using current technology at current prices, with current commercial terms and government consent, also known in the industry as 1P. Some industry specialists refer to this as P90, i.e., having a 90% certainty of being produced. Proven reserves are further subdivided into "Proven Developed" (PD) and "Proven Undeveloped" (PUD). PD reserves are reserves that can be produced with existing wells and perforations, or from additional reservoirs where minimal additional investment (operating expense) is required. PUD reserves require additional capital investment (drilling new wells, installing gas compression, etc.) to bring the oil and gas to the surface.

- Probable Reserves - defined as oil and gas "Reasonably Probable" of being produced using current or likely technology at current prices, with current commercial terms and government consent. Some Industry specialists refer to this as P50, i.e., having a 50% certainty of being produced. This is also known in the industry as 2P or Proven plus probable.

- Possible Reserves - i.e., "having a chance of being developed under favourable circumstances". Some Industry specialists refer to this as P10, i.e., having a 10% certainty of being produced. This is also known in the industry as 3P or Proven plus probable plus possible.

Reserve booking

|

|

|

Oil and gas reserves are the main asset of an oil company. Booking is the process by which they are added to the Balance sheet. This is done according to a set of rules developed by the Society of Petroleum Engineers (SPE). The Reserves of any company listed on the New York Stock Exchange have to be stated to the U.S. Securities and Exchange Commission. In many cases these reported reserves are audited by external geologists, although this is not a legal requirement. The U.S. Securities and Exchange Commission rejects the probability concept and prohibits companies from mentioning probable and possible reserves in their filings. Thus, official estimates of proven reserves will always be understated compared to what oil companies think actually exists. For practical purposes companies will use proven plus probable estimate (2P), and for long term planning they will be looking primarily at possible reserves.

|

|

|

Other types of risk also exist: economic risk, technological risk, and political risk. Economic risk is the probability that the oil exists but cannot be produced at current prices and costs. There is a vast quantity of oil in this category, so economists will always be more optimistic than geologists. Technological risk is the probability that the oil exists but cannot be produced using existing technology. Again, there is a great deal of oil and near-oil in this category, such as the world's oil shale deposits. Political risk is the risk that oil exists but cannot be produced because political conditions prevent it. Since most of the world's oil is in politically unstable countries, political risk is usually the biggest risk and the most difficult to quantify.

Strategic oil reserves

Many countries maintain government-controlled oil reserves for both economic and national security reasons. Although there are global strategic petroleum reserves, the following highlights the strategic reserves of the top three oil consumers.

The United States maintains a Strategic Petroleum Reserve at four sites in the Gulf of Mexico, with a total capacity of 0.727 gigabarrels of crude oil. The sites are enormous salt caverns that have been converted to store crude oil. The US SPR has never been filled to capacity; the largest amount reached thus far was 0.7 gigabarrels on August 17, 2005. This reserve was created in 1975 following the 1973-1974 oil embargo, and as of 2005 it is the largest emergency petroleum supply in the world. At current US consumption rates (over 7 gigabarrels per year), the SPR would supply all normal US demand for approximately 37 days.

In 2004 China's National Development and Reform Commission (NDRC) began development on a 101.9 million barrel strategic reserve. This strategic reserve plan calls for the construction of four storage facilities. An updated strategic reserve plan was announced in March 2007 for the construction of a second strategic reserve with an additional 209.44 million barrels. Separately, Kong Linglong, director of the National Development and Reform Commission's Foreign Investment Department, said that the Chinese government would soon move to establish a government fund aimed at helping its state oil groups purchase offshore energy assets.

As of 2003 Japan has a SPR composed of the following three types of stockpiles; state controlled reserves of petroleum composed of 320 million barrels, privately held reserves of petroleum held "in accordance with the Petroleum Stockpiling Law" of 129 million barrels, privately held reserves of petroleum products for another 130 million barrels. The state stockpile equals about 92 days of consumption and the privately held stockpiles equal another 77 days of consumption for a total of 169 days or 579 million barrels. These reserves are particularly important for Japan since they have practically no domestic petroleum production and import 99.7% of their oil.

OPEC countries

Many countries with extensive oil reserves are members of the Organization of the Petroleum Exporting Countries, or OPEC. The members of the OPEC cartel hold about two-thirds of the world's oil reserves, allowing them to significantly influence the international price of crude oil.

Oil reserves by country

As the amount of oil left is an estimate, not a known amount, there are many differing estimates for the amount of oil remaining in different regions of the world. The large range of some country's estimates, Canada and Venezuela in particular, stems from factors such as the potential future development of non-conventional oil from tar sands, oil shale, etc.

Дата добавления: 2019-01-14; просмотров: 244; Мы поможем в написании вашей работы! |

Мы поможем в написании ваших работ!