Contracts in the form of decentralized executable programs

Each contract requires ether to be executed. This measure is intended to exclude situations with the endless work of the programs, since their execution stops as soon as the ethers selected during the call end. The contract call itself also requires a small amount of ether, which ultimately goes to the node that succeeds in successfully sending the next block to the blockchain. Nevertheless, it is possible to directly send a certain amount of ether to one or another contract during its call to transfer the balance, for example, for the purpose of payment.

The execution of certain actions of the program is possible due to the transfer of parameters to the methods of program instructions. The execution of the method can change the state of the contract by adjusting the values of one or more of its fields. A contract may also have a set of events used to notify interested parties of the results of a particular event throughout the duration of the contract. By default, the life of any new contract in the system is unlimited. However, when creating a contract, its initiator may set the possibility of self-destruction when, after a certain time or certain conditions have been fulfilled, the contract ceases to exist, and its entire ether balance is transferred to another account.

Messages and files exchange

In addition to a special virtual machine for executing contract logic, the Ethereum project also introduced two additional protocols implementing peer-to-peer messaging and static files. The peer-to-peer distributed messaging protocol is called whisper. It provides users with excellent opportunities for personal, secure communication, with support for sending messages to one or more recipients and sending broadcast messages. The peer-to-peer protocol for exchanging static files is called swarm. It offers a new, motivation-based approach to placing static content for other members of the network with the ability to efficiently share files.

Picture №4 Connection between Swarm, whisper and Etherium

Decentralized messaging

Whisper is a peer-to-peer protocol for confidential messaging with a short lifespan. The message header (subject) in Whisper is hashed, and the messages themselves can be encrypted with keys to protect data. Indirect support for broadcast and group broadcasting is included. Designed for a weak Internet channel and high data transfer delays. Provides the ability to use masks / filters for more efficient search for topics of interest (titles) without giving out their specific name.

|

|

|

Motivated file sharing

Swarm's work is based on using the main advantages of the Ethereum infrastructure - contracts and ether. Files are divided into parts stored on network nodes. To keep track of the sent and received parts of the files, the nodes use a special accounting protocol, and the activity of the nodes is paid for by micropayments, a measure designed to encourage cooperation between them.

After examining the complex device Ethereum sometimes you can ask the question: "And why is it all?". The Around The Block team has collected practical examples of Ethereum.

Sometimes it is not easy to talk about specific cases of its use, even for those who understand the concepts of the blockchain, Ethereum and smart contracts. Therefore let's consider this question more attentively.

The main themes of the examples cited here are the minimization or complete elimination of trust, the improvement of certain areas of human activity and revolutionary ideas. During the reading, pay attention to how by simply getting rid of intermediaries, the question of payment of operating commissions related to trust and reputation, as if by itself, disappears and how the described changes endanger established business models in a number of industries. However, it should also be borne in mind that many of the applications described are at a very early stage of development and it is not possible to say which of them will “take off” and which ones fail.

Projects with Etherium

Social network AKASHA

Faced with censorship by a drunken moderator on your favorite forum? The AKASHA team is working on a decentralized online community service and a smart rating system for them. Thanks to open source code and regulation on the basis of smart contracts, the scandals associated with censoring will very soon become a thing of the past[1].

You can publish, share and vote for entries, similar to Medium and other modern publishing platforms, with the difference that your content is actually published over a decentralized network rather than on AKASHA servers. Moreover, the votes are bundled with micro transactions so if your content is good you’ll generate value – in a way, mining with your mind.

|

|

|

Picture №5 AKASHA Logo

In today’s blockchain realm, AKASHA is a social and technological experiment enabling our collective memory, feelings and ideas to echo freely throughout humanity’s existence. By fusing Ethereum with the Inter-Planetary File System, AKASHA explore the implications and applications of a permanent Web in the context of freedom of expression, creative perpetuity, and privacy for a better home of Mind.

ConsenSys

ConsenSys - application development studio, led by co-founder Ethereum Joseph Lubin. ConsenSys is developing a huge range of products specifically designed for developers. These applications will hardly seem interesting to the average consumer, but for developers who want to get to the Ethereum scene they will be very useful.

Projects address every part of the Ethereum ecosystem, including: crucial infrastructure projects, developer tools, core integration components, services, B2C dapps, enterprise solutions, and many more platforms and applications. ConsenSys have a robust education arm training developers and educating the ecosystem, a Social Impact group accelerating humanitarian efforts, and a media platform publishing news and thought pieces about the ecosystem.

ConsenSys was formed in 2015 and has since grown to over 1100 employees distributed globally in every continent except Antarctica. Structurally, we are as flat, decentralized, and fluid as we can be, allowing individuals and groups to self-organize and adapt as needed. Despite our rapid growth, we adhere to our flat structure as much as possible, believing that autonomy and agility are key to a project’s and employee’s success.

11 Benefits of Enterprise Ethereum[2]

Ethereum is designed to be low-cost, open, flexible, and suited for cooperation between multiple parties. In terms of coordinating data, Ethereum functions much like a distributed ledger, but its architecture also has unique layers that both strengthen and create new possibilities for business systems. For those who want to understand the different functionalities in-depth, Protocol Business Architect Brent Xu has written an incredibly thorough, two-part comparison of blockchain vs. distributed ledger technologies. These are the current capabilities of Enterprise Ethereum:

|

|

|

Data coordination. Ethereum’s decentralized architecture better allocates information and trust so that network participants do not have to rely on a central entity to manage the system and mediate transactions.

Rapid deployment. With an all-in-one SaaS platform like Kaleido, enterprises can easily deploy and manage private blockchain networks instead of coding a blockchain implementation from scratch.

Permissioned networks. Kaleido’s Blockchain Business Cloud enables enterprises to form consortium networks in which privileged nodes can function as gatekeepers or regulators (i.e. stop executions, see encrypted state information in plaintext, etc). PegaSys, ConsenSys’ protocol engineering spoke, is currently developing Pantheon, an Apache 2.0-licensed Ethereum Java client which can be used for both public and private network use cases.

Network size. The mainnet proves that an Ethereum network can work with hundreds of nodes and millions of users. Most enterprise blockchain competitors are only running networks of less than 10 nodes and have no reference case for a vast and viable network. Network size is critical for enterprise consortia that are bound to outgrow a handful of nodes.

Private transactions. Enterprises can achieve granularity of privacy in Ethereum by forming private consortia with private transaction layers. Constellation, Quorum’s privacy module, uses privateFor parameters to allow participants to exchange private transactions. PegaSys has open sourced Orion, a Java-based private transaction manager that facilitates transactions between authorized parties. PegaSys also recently ported private transaction capabilities from Zcash into Ethereum using smart contracts.

Scalability and performance. With Proof of Authority consensus and custom block time and gas limit, consortium networks built on Ethereum can outperform the public mainnet and scale up to hundreds of transactions per second or more depending on network configuration. Protocol-level solutions like sharding and off-chain, layer 2 scaling solutions such as Plasma and statechannels present opportunities for Ethereum to increase its throughput in the near future.

|

|

|

Finality. A blockchain’s consensus algorithm secures confidence that the record of transactions remains tamper-proof and canonical. Ethereum offers customizable consensus mechanisms including RAFT and IBFT for different enterprise network instances, ensuring immediate transaction finality and reducing the required infrastructure that the Proof of Work algorithm demands.

Incentive layer. Ethereum’s cryptoeconomic layers allow business networks to develop mechanisms that both punish nefarious activity and create rewards around activities such as verification and availability.

Tokenization. Businesses can tokenize any asset on Ethereum that has been registered in a digital format. By tokenizing assets, organizations can fractionalize previously monolithic assets (real estate), expand their line of products (provably rare art), and unlock new incentive models (crowdsourced data management).

Standards. Ethereum is where the standards are. Protocols around token design (ERC20), human-readable names (ENS), decentralized storage (Swarm), and decentralized messaging (Whisper) keep the ecosystem from balkanizing. For enterprises, the Enterprise Ethereum Alliance’s Client Specification 1.0 defines the architectural components for compliant enterprise blockchain implementations. The EEA is planning to release version 2.0 of the spec soon.

Interoperability and open source. Consortia on Ethereum are not locked into the IT environment of a single vendor. Amazon Web Services customers, for example, can operate private networks with Kaleido’s Blockchain Business Cloud. Like the Java community’s spec-driven philosophy, the Ethereum ecosystem welcomes contributions to the codebase through Ethereum Improvement Proposals (EIPs).

Etherium in Banking Sphere

Problem

For the banking industry, the cost of providing the utmost reliability, availability, and resilience against attacks or equipment failure is high. If a central bank’s servers go down, a country’s payment clearing system would collapse. Large institutional banks routinely spend upwards of $200 million dollars a year on cybersecurity. Reconciliation payments — the balancing between different sets of accounts — are also byzantine and inefficient. A single payment can involve four different transactions to move money from one account to another. Moreover, the burden of reporting on suspicious transactions falls on banks.

Opportunity

If every bank in a payment network transacted through the decentralized execution space of a blockchain, the network would have no single point of failure: a country could maintain its interbank payment network even if one or several servers go down. Banks could transact directly, reducing friction and decreasing the odds of double-spending and fraud. A blockchain’s distributed and immutable ledger also simplifies regulatory reporting. Regulators could pull data in real-time from a single source of truth.

Applications for banking and financial services

Santander’s cash tokenization utility [3]. ConsenSys has collaborated with Santander Bank to develop a cash tokenization utility and real-time payment system for domestic and international payments on Ethereum. Payments are cleared, settled, and disbursed in 10–15 seconds.

Project Ubin. Last year [4], ConsenSys partnered with the Monetary Authority of Singapore to develop and open source software prototypes for decentralized interbank payment and settlements with liquidity savings mechanisms.

Project i2i [5]. ConsenSys partnered with Union Bank of the Philippines to build a closed-loop crypto-cash solution for rural banks in the Philippines on Kaleido, an all-in-one enterprise SaaS platform.

Project Khoka [6]. In a consortium with seven commercial banks, the South African Reserve Bank conducted a proof-of-concept trial with Quorum, an enterprise-grade implementation of Ethereum, to process the typical daily volume of payments with full confidentiality and finality in less than two hours. Adhara, a ConsenSys venture, is building a multi-currency liquidity management and international payments platform to optimize banks’ capital deployment, manage risk, and leverage liquidity effectively and globally.

Project Endor . ConsenSys recently partnered with capital raising platform CapBridge on Project Endor with the aim of developing a fully compliant securities exchange on the public Ethereum blockchain.

Commodity Trade Finance

Problem

Rapid globalization has outpaced the trade finance industry’s ability to standardize and digitize its system of record-tracking. The exchange of commodities — all with very unique regulations, shipping specifications, and certification requirements — is currently managed across different borders and jurisdictions on a paper-based system that is prone to fraud and leaves stakeholders waiting for payment.

Opportunity

A blockchain would serve as as secure, streamlined, and paperless platform on which only authorized parties — banks, commodity traders, inspection companies, and governments — could exchange data and transaction records.

Application

After a series of proven use cases around soya beans and crude oil, fifteen of the world’s largest banking and commodity companies have officially announced the formation of komgo, a trade financing network supported by Komgo SA’s blockchain-based trade financing platform. By sharing user data via end-to-end encryption and digitizing letters of credit, komgo is restoring confidence to the KYC process and providing assurance to banks that temporarily own commodities as collateral on their loans.

Supply Chain

Problem

Global supply chains today — which support everything from fast-moving consumer goods (FMCG) to food and beverage (F&B) — are inefficient, poorly tracked, and oftentimes exploitative. In the container industry, paperwork can account for half the cost of transport. A nationwide study conducted in the US from 2010 to 2012 by the international ocean advocacy organization Oceana revealed that seafood is mislabeled up to 87% of the time. Mica, which is used in makeup, electronics, and automobile paint because of its shimmery, reflective properties, is often sourced from illegal mines by child laborers younger than 12 years old.

Opportunity

A blockchain’s public, permanent record of transactions would bring transparency and accountability to the movement of goods and commodities across the globe, from source point to end customer. A shared IT infrastructure would streamline workflows for suppliers, distributors, manufacturers, and retailers, and auditors would have greater visibility into participants’ activities along the chain.

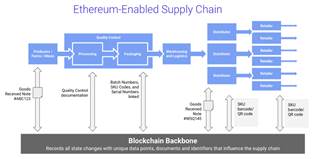

Picture №6 Etherium-Enabled Supply Chain

Applications for supply chain management

· Viant. Viant [7], a supply chain track and trace platform built on Ethereum, teamed up with Microsoft earlier this year to help the World Wildlife Fund deploy a program which verifies that fish are harvested from sustainable sources. Viant is also working with pharma giant GlaxoSmithKline to track intellectual property licenses used by scientists and ensure that products are produced, transported, and stored in proper conditions.

· Luxarity. [8]ConsenSys Social Impact recently partnered with Luxarity, the social venture arm of Hong Kong fashion retail brand Lane Crawford, to register resold luxury goods on the blockchain so donors can track charitable proceeds.

· Minerac. Minerac [9], a joint venture between ConsenSys and the metal concentrates trade platform Open Mineral, is an Ethereum-based consortium of mining companies and financial institutions which both eases and secures the exchange of critical trade documents such as bills of lading and letters of credit across different jurisdictions.

· GenuineWay. A consortium of over 500 authorized suppliers and distributors, GenuineWay applies QR codes to food and liquor items and deploys smart contracts to certify the manufacturer of artisanal food products for end consumers.

Government

Problem[10]

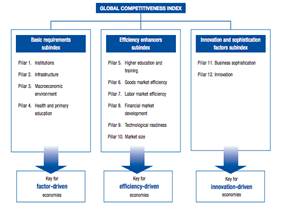

In the wake of 2008’s global economic crisis, governments are being held to higher accounting and reporting standards to bolster investor and consumer confidence. The World Economic Forum’s Global Competitiveness Index ranks national economies along 12 pillars including infrastructure, market efficiency, and business sophistication. Citizens and businesses need a

robust digital infrastructure to access basic

services and to get their products to market in a secure and expedient fashion. Governments must also furnish proof that the spending of public revenue is efficient and effective.

Picture №7 WEF Global Competitiveness Report 2017–2018[11]

Opportunity

The most immediate benefit of a blockchain solution would be the creation of a secure, paperless layer for all government documentation: government agencies could digitally process visa applications, bill payments, license renewals, and more through Ethereum’s encrypted ledger, reducing paper load, document processing time, and duplication errors. A blockchain-based identity management system would also give documentless citizens publicly registered and portable identification.

Applications

uPort is setting the standards for privacy-preserving identity solutions and helped the Swiss city of Zug develop ZugID, which enables citizens to access e-government services in a trusted and self-reliant manner. Last year, the uPort team also launched a pilot program with the Brazil Ministry of Planning that verifies government IDs and signed documents on-chain. While some governments have been slow to accept blockchain technology, several have taken initiative to prototype and deliver blockchain-based solutions around land registries (Dubai), electronic voting (Estonia), energy statistics (Chile), and internal messaging tools (Israel).

Last year, Dubai appointed ConsenSys as Blockchain City Advisor as part of their Smart Dubai Initiative to document all government records and transactions on the blockchain by 2020, and will soon issue emCash, a state-developed cryptocurrency. Earlier this year, the EU also launched a Blockchain Observatory and Forum and selected ConsenSys as its partner to help align and develop a blockchain-enabled and unified European market.

Energy Grid

Problem[12]

Solar arrays and wind farms have proven to be such abundant sources of renewable energy that they’ve become a problem for the energy grid, which is currently not equipped to store or redistribute the load. To prevent overvoltage and damage to the wires, balancing authorities in some regions must respond by curtailing production and in some cases even paying solar generators to not produce energy. Solar and wind generation is also intermittent — affected by local cloud cover and weather conditions — causing rapid drop-offs or increases in produced energy which must be buffered by other energy producers to maintain grid stability.

Opportunity

The widespread adoption of low-cost distributed energy resources such as solar panels and wind turbines in recent years presents an opportunity to build a durable, sustainable, and transactive energy grid. A blockchain-enabled delivery system would not only create long-term incentives for consumers to build their own distributed energy storage capabilities and trade energy locally, but it would undercut costs of incumbent utilities, automate billing and settlement, and clear payments in real-time so utilities wouldn’t have to pool risk.

Picture №8 Energy Grid Connection

Application

This past summer, Grid+ obtained a certificate from the Public Utility Commission of Texas to operate a Retail Energy Provider and in coming weeks will begin accepting GRID tokens from customers to access wholesale energy prices. By moving the transaction logic for both energy and payments onto the Ethereum blockchain’s trusted architecture, Grid+ reduces the administrative burden of processing transactions over legacy rails (traditional payment processors typically charge fees of 1.5–2.5%). Moreover, by pushing market signals to customers, Grid+’s energy trading solution enables customers to make smarter decisions about their energy usage and react to the economics of the demand response market.

Oil and Gas

Problem

While the world continues to scale the infrastructure for renewable energy distribution, crude oil remains a resource for both energy needs and the vast array of everyday petroleum products. Petroleum is one of the most globally-traded commodities in today’s economy, but the industry — a behemoth of upstream, midstream, and downstream providers, refiners, tankers, jobbers, governments, and regulatory bodies — suffers from siloed infrastructures and countless issues of transparency, efficiency, and optimization[13].

Oil and gas companies today use proprietary systems to track, manage, and record data in order to perform trades. These centralized systems are difficult and expensive to maintain. Oil and gas commodity trading can often be a razor-thin profit economy, so optimization of any kind is critical for a company’s bottomline. Moreover, these centralized IT infrastructures are prone to hacking, manipulation, and corruption. Last year, Siemens conducted a survey of U.S. oil and gas cybersecurity risk managers and revealed that 68% of operations experienced at least one security compromise.

Opportunity

A blockchain solution in the oil and gas commodity marketplace would not only reduce the costs associated with maintaining, updating, and securing proprietary trading systems, but also the costs associated with labor, data management, data visibility, settlement delays, dispute resolution, and inter-system communication — all without compromising proprietary data, information sources, or trading methods that currently give companies competitive edge. Enterprise Ethereum’s permissioning and privacy functions would enable trading companies to create custom access restrictions and privacy layers, so that industry participants can transact across a single, secure platform without exposing confidential transaction data. Increased data transparency (to permissioned individuals) would also mean companies can provide access to regulators on a frequent and low-cost basis.

Application

Ondiflo is a joint venture between ConsenSys and Amalto, a B2B integration leader for the oil and gas industry, which aims to provide bespoke, enterprise-grade blockchain solutions to oil and gas companies in the upstream, downstream, and midstream segments. Since its launch in February 2018, Ondiflo has focused on two solutions: 1) consortium-building between oil and gas stakeholders and 2) a platform for all ticketing-based services to ease reconciliation around identity, certification, field capture errors, data sanitation, and financial settlement.

Law

Problem

Since the earliest written arrangements, our world has been structured through legal prose and contractual agreements. While agreements are no longer memorialized in clay, the legal industry — a $437 billion industry in the US — has failed to take advantage of advances in computing to streamline and simplify contract creation. Most lawyers use written templates derived from previous work and laboriously draft agreements in legalese, which can create ambiguity and further risk of litigation. Simple draftsmen’s errors around comma usage can spiral into legal back-and-forth (a la the Oakhurst Dairy drivers’ overtime dispute).

Agreement is another story. Once a legal contract is revised, reviewed, and finalized, signature pages are swapped between parties and generally signed using ink. For large agreements, getting these signatures usually requires the assistance of an overqualified associate, which slows down the closing of complex transactions. Storing legal agreements is also an unorganized and insecure process. Agreements often sit as attachments in emails, in vulnerable document management systems, or as hard copies in literal filing cabinets.

Opportunity

It’s not difficult to imagine how Ethereum-based smart contracts could completely renovate the legal industry. Legal documents could be embedded into smart contracts and templatized to ease the creation, execution, and arbitration of legal agreements. Public-key cryptography, a cornerstone function for authenticating and encrypting blockchain-based transactions, would replace the scramble of gathering pen and paper signatures with a swift and secure electronic signing system.

Application

OpenLaw, the first project to enable “smart” legal contracts, is reimagining the creation, execution, and storage of legal agreements from the ground up. OpenLaw’s legal markup language provides an easy way for anyone to reference and trigger an Ethereum-based smart contract to manage contractual promises. Using the OpenLaw protocol, legal agreements can be embedded in lines of code in an Ethereum smart contract and automatically triggered once the agreement is digitally signed by all parties. OpenLaw has partnered with McCarthy-Tétrault to automate key aspects of the lending process, as well as Rocket Lawyer to develop trusted and blockchain-enabled contract execution.

Real Estate

Picture №9 Cottages

Problem

The current real estate market has three main problems: inaccessibility, transaction costs, and poor liquidity. Real estate ownership and investment has been historically reserved for the wealthy because of the capital reserves and credit rating required to put money down and take out a mortgage on a new home. For those who manage to swim upstream to ownership, purchasing a home involves up to eight middlemen (brokers, legal counsel, inspector, appraiser, etc.), who altogether siphon off up to 5% of a home’s value. For investors, REIT brokers usually take 9–10% in commissions and fees. Finally, getting in and out of real estate assets is slow and arduous. Renters face lock-in periods, sellers have limited options for selling a fraction of a property, and investors who can buy into a REIT are still subject to a portfolio manager’s personal investment strategy and fee structures.

Opportunity

Ethereum’s decentralized architecture and smart contract functionality would obviate the need for multiple intermediaries in a real estate transaction and enable automated payouts of rental income. Particularly exciting is the opportunity to “tokenize” properties. By issuing real estate-backed tokens on the Ethereum blockchain, asset owners can fractionalize previously monolithic properties into almost infinite slices and unlock additional capital and a diverse pool of investors.

Applications

ConsenSys partnered with Dubai Properties to build a blockchain platform for tracking the provenance of real estate from planning and construction to customer sale using cryptographically secure digital signatures. Meridio, a ConsenSys venture that spun out of the engagement with Dubai Properties, converts individual properties into digital shares on the Ethereum blockchain. Accredited investors can purchase tokens on the Meridio platform — which represent fractional shares of properties — and reap a proportionate amount of rental income. Meridio’s Ethereum-based real estate marketplace exposes asset owners to a diverse pool of investors so owners can access capital, streamline transaction processing, and analyze asset-specific data in real time. Investors benefit from low capital requirements, reduced transaction fees, and increased portfolio liquidity.

Дата добавления: 2019-02-22; просмотров: 190; Мы поможем в написании вашей работы! |

Мы поможем в написании ваших работ!